Hello, this is Deirdre Browning Sullivan, AG of Maryland, DC, and Virginia. Today, we're going to talk about Maryland transactions where the seller is a non-resident. In the state of Maryland, if your seller is a non-resident, we are required as the title company to take additional tax withholdings and send them to the state of Maryland. If the seller is an individual, we must take 7.5% of the proceeds and send it to Maryland. However, if the seller is an entity, such as an LLC or corporation, we are required to take 8.25% of the proceeds and send it to the state of Maryland. There are some exceptions to these requirements. For example, if your entity has registered in the state of Maryland to do business more than 90 days before the sale, then we do not need to take that withholding. If you are an individual, there is a form you can fill out and send to the Office of Tax and Revenue. On this form, there are major exceptions that you may be able to qualify for. For instance, if you are selling the property and not receiving any proceeds back (zero), or if you have recently moved out of the property that was your principal residence and purchased another property, you would just need to show Maryland that you actually lived in the property as your principal residence for two of the last five years and paid personal property taxes there using that address. Once you fill out this exception form and send it to the Office of Tax and Revenue, there is a space where you can provide the name of your title company. They will then send us a certificate showing that we are no longer required to withhold the funds. Another commonly asked question is what happens...

Award-winning PDF software

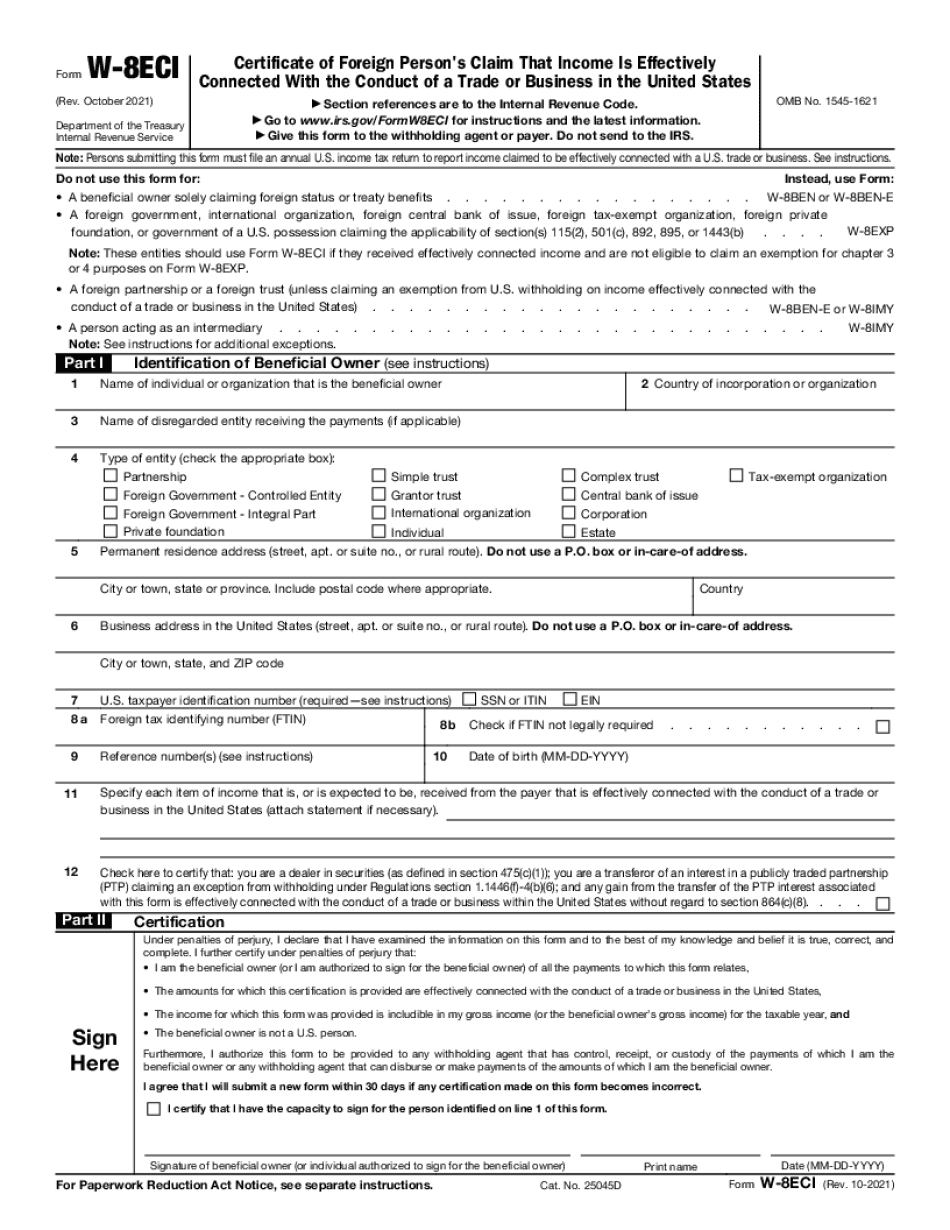

W-8eci rental income Form: What You Should Know

IRC Section 72(t)(2) — Exemptions From Tax Withholding Rules If a US resident and your gross rental income is more than 600 for any month, the IRS will withhold 30% of income tax withheld on that income. If your gross rental income is not more than 600, but is more than 600 for any month or 1,000 for any two consecutive months, the IRS will withhold tax withholding 30% of a 600 and 1,000 for any month or 600 for any two consecutive months. If you do not pay this tax by January 2023, the IRS will use the 600 and 1,000 income limits provided below to calculate the amount of tax you owe. Tax is only due if you do not pay by January 2023. How to complete Form W-8ECI — IRS Oct 12, 2025 — If you are an LLC, an S corporation, a partnership, or a sole proprietor, you may use Form W-8ECI to file this form. If you are a corporation, you may use Form W-8ECI to file this form. You cannot file Form W-8ECI if you are a sole proprietor. Form W-8ECI and the IRS' Notice, Revenue Ruling 2150 For a complete copy of IRS Notice, Revenue Ruling 2150: A Notice to Individuals Using a Foreign Real Property Residence for Business or Investment, See Internal Revenue Bulletin 2003-41, Exemption from U.S. Income Tax on Foreign Income for information on US taxpayers withholding tax on income earned through foreign real property residences and on the conditions under which a foreign person may qualify for the withholding exemption. For detailed information on how to file a Form W-8EC, download the forms online, fill them out, and mail them to the Department of Revenue. If the IRS makes some changes to its rules for Form W-8EC, the form, as well as the instructions for completing Form W-8EC, may need to be altered. When the IRS updates the forms, they will indicate which of the forms have changed. Follow the instructions on the form to make the necessary changes. Note: Do not enter anything other than the tax withheld or the required amounts on the form, unless the form is updated specifically to show how to apply. In doing so, you will not be making any changes to your tax liability.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-8eci, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-8eci online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-8eci by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-8eci from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W-8eci rental income