Hello and welcome back to the dividend experiment. Today, we're going to talk about the W8-Ben form and why you need to fill it out if you're an American or US citizen. Then, you probably don't know what a W8-Ben form is and you don't need to. In fact, you can just skip this video. Feel free to leave a like because I just saved you Americans some time. Okay, so if you are still here, then this video is going to explain just how important filling out that W8-Ben form is for dividend investors. If you are not a US citizen, you are still permitted to buy US stocks on the US stock exchange. Think of all those great companies that call the USA home. They have some of the biggest and best companies in the world, a huge rich market. As foreign investors, we should consider ourselves very fortunate. They allowed us to buy these companies. However, the US government isn't just letting us buy these stocks out of the kindness of their heart. Oh, they want their cut too. They want to take 30% of the money we receive from our US income sources. Now, this is not ideal for us dividend investors at all. Let's take a look at exactly what it means: a 1% yield becomes a 0.7% yield, a 2% yield becomes a 1.4% yield, a 5% yield becomes a 3.5% yield, and a 10% yield becomes a 7% yield. Well, yeah, you get the point. So, what can we do about this? Well, this is where the W8-Ben form comes in. If we fill in one of those, then we cut the 30% withholding tax in half, bringing it to the much more manageable 15%. Ideally, we would be paying zero, of course, but 15%...

Award-winning PDF software

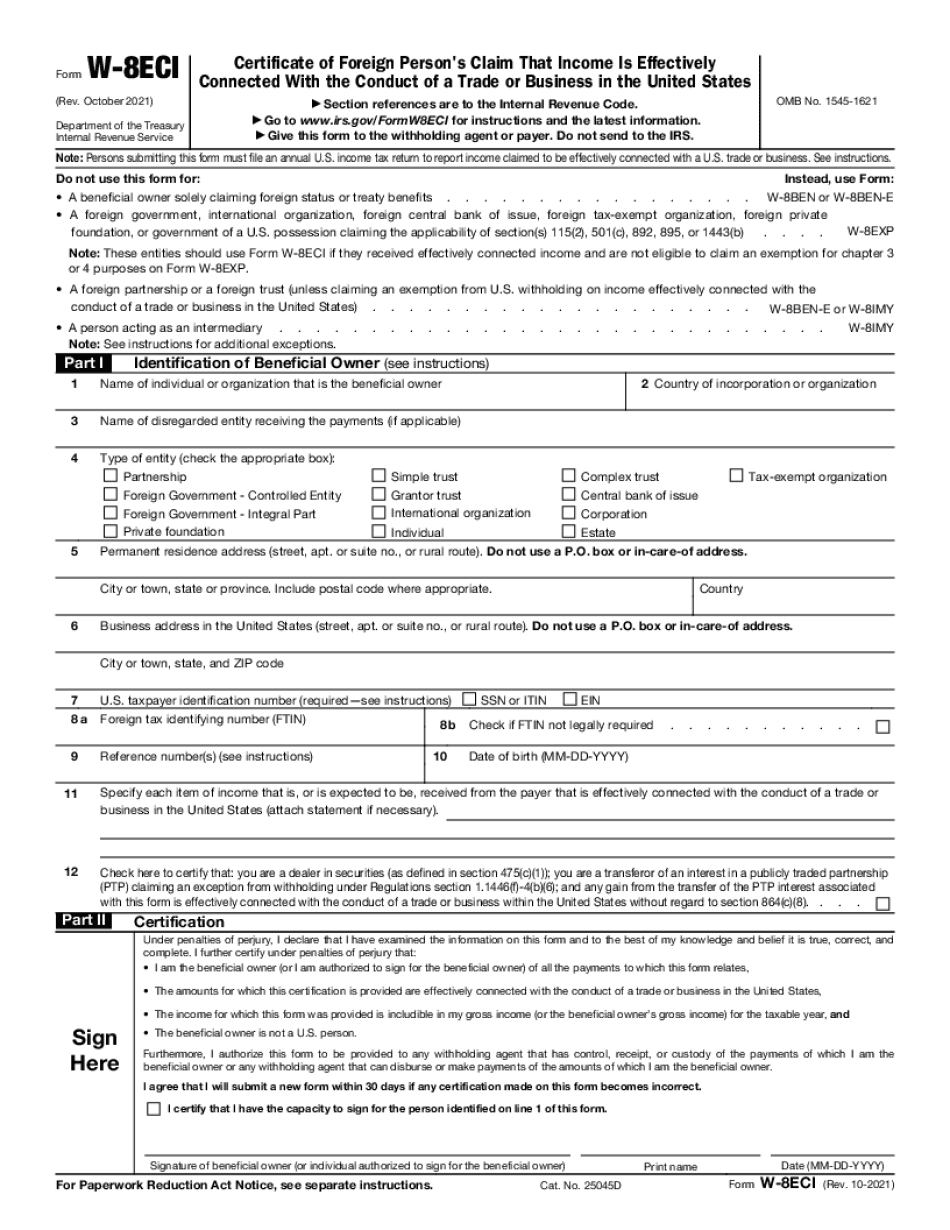

w-8eci instructions Form: What You Should Know

Where to find the Form W-8 PCI for the U.S. owner Instructions for Form W-8 PCI — (Rev. February 2018) The form must be signed and dated by the person whose name is on the 'Name' line or their authorized representative. See the IRS Form W-8ECI and accompanying How to complete Form W-8ECI — (Rev. February 2018) The form must be signed and dated by the person whose name is on the 'Name' line or their authorized representative. See the IRS Form W-8ECI and accompanying Form W-8ECI, Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States. The form must be signed and dated by the person whose name is on the 'Name' line or their authorized representative. See the IRS Form W-8ECI and accompanying The name(s), social security number, and date of birth must match on the Form W-8ECI. You will be responsible for filing that form with the appropriate IRS field offices and filing IRS Form 4868 with the Form 1040A. The information needed to complete the I-8 Certification is: The person(s) claiming the income must How to enter the Social Security Numbers on Form W-8ECI The person's name (the legal person and legal representative) and social security number must appear on the Form W-8ECI. If your person does not have an SSN, you can use the name(s) listed for the individual on their US passport: if the passport is issued by the U.S. government, if the passport is a “Certificate of Registration of a Foreign National as a Nonresident Alien,” or, if the passport is a “Certificate of Nationality or a Photocopy of a United States Passport,” the SSN can be added to the U.S. Passport by using the instructions on Form 4868. Where can I search for information about the I-8 Certification? You can enter the Social Security Number to find information about I-8 Certificates on the Internet at .

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-8eci, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-8eci online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-8eci by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-8eci from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form w-8eci instructions