Award-winning PDF software

W-8ben instructions Form: What You Should Know

However, you should identify yourself as a United States taxpayer with U.S. citizenship (or United States citizenship with another country).4. If you are not sure whether you are a resident of the United States, complete Form W-8BEN regardless of whether you identify. (If you are not a United States citizen, you may complete Form W-8BEN and apply for a certificate of entitlement and a certificate of loss of United States citizenship.) Part II — Information on Your Beneficiary: Fill out the blanks under the relevant entries on Form W-8BEN. Your beneficiary should have a mailing address or physical address at a U.S. domestic post office box. Form W-8BEN. 5. The name and birthdate of your beneficiary. A birth certificate is acceptable for a non-resident. 6. The Social Security Number (SSN) or driver's license number of your beneficiary. A driver's license or other proof of citizenship is acceptable if you must have a driver’s license, or other proof of U.S. citizenship, available to prove your citizenship. If it is not possible to obtain a driver's license or other proof of U.S. citizenship, use a letter dated from your foreign government indicating that all documents furnished in connection with your Form W-8BEN are satisfactory. 7. The name, sex and date of birth of all children who are the dependent of your beneficiary. 8. If your beneficiary is a United States citizen or resident alien, a certificate showing that you are entitled to the child's U.S. citizenship or naturalization benefits, if any. A Form W-8BEN signed under penalty of perjury is effective for the entire tax year, even if the tax was not assessed during or after the calendar year in which it was issued. If your Form W-8BEN does not specify a deadline for filing it, the IRS generally will not require you to complete this form after you have been subject to any penalties. Part III — General Information: 8. The name and address of the person, legal entity or other organization to which you are or will become entitled (if you have no United States citizenship or if you are not a lawful permanent resident). 9. This section covers the various filing requirements and filing deadlines for Form W-8BEN (or other federal income tax returns). 10.

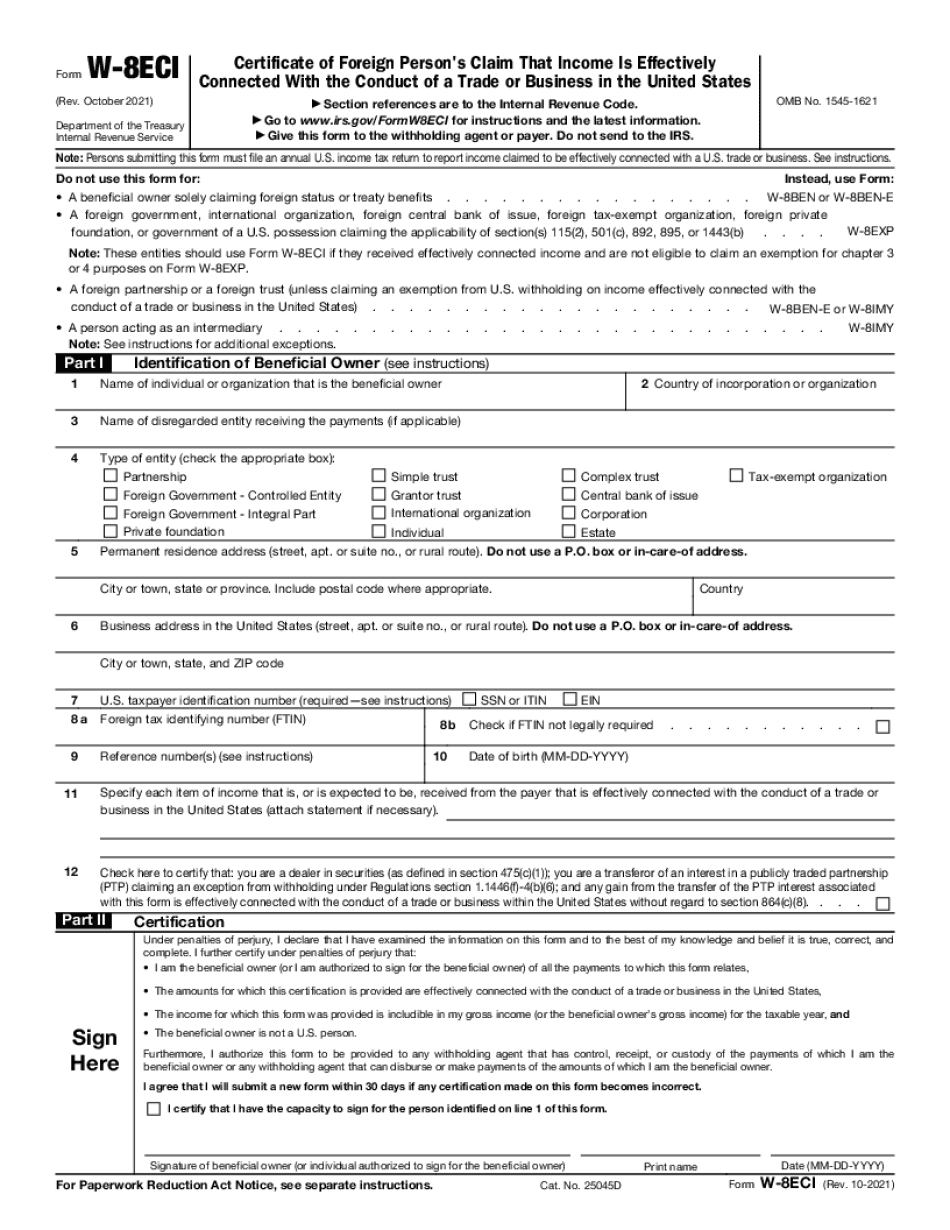

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-8eci, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-8eci online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-8eci by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-8eci from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.