Award-winning PDF software

Canadian w 9 Form: What You Should Know

You hold a U.S. passport and provide your Usual Wage This could be a Canadian or U.S. person. A Canadian is considered a person who “receives compensation for services” and is taxable, and it doesn't matter where they get such compensation. The U.S. person could be an employee, a business partner, Employee of a U.S. corporation or partnership, a shareholder of a U.S. corporation or partnership, or a U.S. partner-in-crime of the U.S. person. It doesn't matter whether the U.S. person receives income by being in the U.S., living in the U.S., or being based outside the U.S. This person is considered a “foreign person” and has to file a Form W-8BEN, and the U.S. person is taxed on wages received as a result of the foreign person's foreign business activity as if the U.S. person was on active duty for the U.S. The person also has to withhold and pay Social Security and Medicare taxes, but these are usually considered “social insurance taxes” and don't count towards the wages on Form W-8BEN The Form W-8 BEN is issued, as soon as practicable after the date the form is received, and is sent to you. You may need it, or you may be able to use an electronic signature on your U.S. tax filing form and pay the withholding tax without a form W-8 BEN. Note that you still have to pay Canadian taxes on the wages. The Canada Revenue Agency does accept the W-8BEN, by mail. If you submit a 1099-B and send that in by mail, a request for a Form W-8 BEN has to be shown on it (you will have to go online to check out if you want a form which is not already done, or print out a form from the Canada Revenue Agency website). Who are the foreign persons who need to file a Form W-8BEN? The Form W-8BEN is generally issued by the Department of Homeland Security, and is issued to the “proprietary partner” and the “associate partner” in the fiduciary relationship.

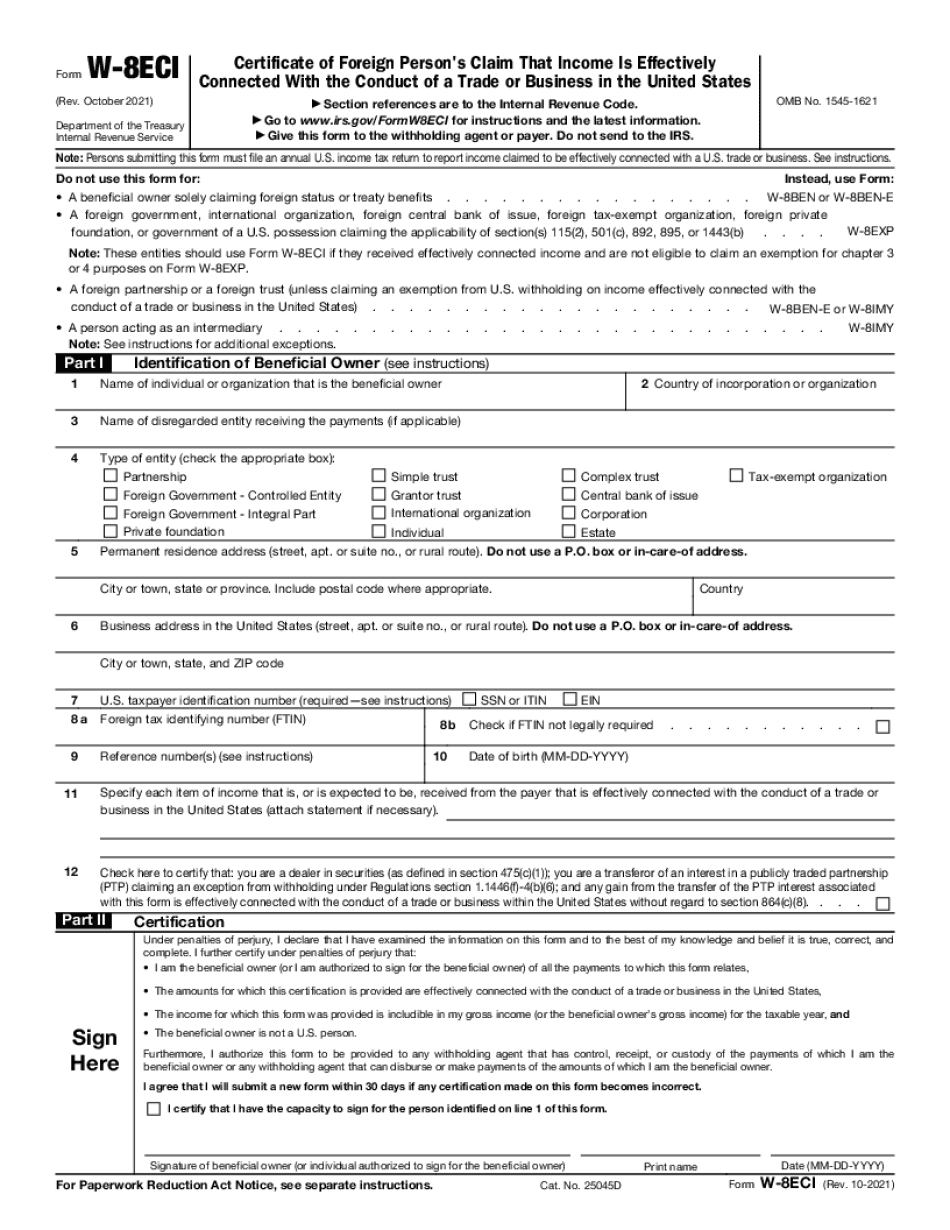

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-8eci, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-8eci online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-8eci by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-8eci from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.