This is Marine Accounts. We offer tax advice and mortgage solutions to yacht crew. We believe strongly in providing free advice that can be used to help your crew make the right decisions with regards to their tax. This lecture acts as part of a series of talks under the topic of keeping your money yours. This lecture will focus on what to do when you receive the letter from your bank, which is regarding your tax residency. The letter is to do with FACTA and CRS. I will not bore you too much about these, but I can tell you they both will affect you and it's something that you need to deal with. The letter itself has shown now artists you to provide your address and also a tax identification number or national insurance number. The letter has come around because of CRS and FACTA and is used by the G20 to monitor where clients or residents. They want to be able to verify that you're not withholding funds and that your country of residence is aware that you have these funds offshore. This initiative has only recently come into existence but it's something that you need to react to. If you choose to ignore this, then there is a potential that your account could be frozen or worse still, closed. The first thing that the forum will ask you to do is to provide an address. So we would suggest that you provide the address of your home. Or if you do not have a home and their home is the yacht, then we suggest that you provide the address of where you would domicile. Your domicile is where you were born and where you hold a valid passport. Secondly, you will need to provide a tax identification number....

Award-winning PDF software

Fatca w 8 Form: What You Should Know

The FATWA Compliance Streamlining program requires non-U.S. residents to submit an acceptable FFI Form. W-8BEN-E: Form to Complete Reporting for Foreign Person to Beneficial Owner The FATWA Compliance Streamlining requires reporting of the existence of a foreign person to avoid certain penalty amounts, including the following: Nonresident and other special non-U.S. Taxpayers who are U.S. residents and are actively involved with a tax return or payee; Nonresident and other special non-U.S. Taxpayers who are U.S. residents living abroad who are active during the filing or payment period; (and) Nonresident and other special non-U.S. Taxpayers who are U.S. residents who are active during the time that is covered by the tax return or payee. If an individual becomes a non-U.S. resident for a period of at least 183 days, the individual also has the rights to claim a tax credit under the Nonresident Business Income Tax Credit Schedule. To claim a U.S. tax credit for the non-resident business income tax credit, the taxpayer must claim an appropriate non-resident business income tax credit amount. The Nonresident Business Income Tax Credit Schedule is an electronic payment program offered to U.S. taxpayers to help them make a non-resident payment. There are multiple amounts, which can be claimed for the first and last three income tax years. The IRS uses FATWA to identify foreign persons and entities and determines their non-U.S. status. The IRS requires FATCA-eligible taxpayers to report relevant foreign income and gain on appropriate IRS-recognized foreign government return(s). For these taxpayers, the FATWA Compliance Streamlining initiative requires the individual to complete a Nonresident Alien Individual Filing Status Taxpayer Identification Number (Form W-8BEN-E). This number will be used by the IRS to process the non-U.S. Resident Filer's FFI for inclusion in the U.S. government's list of FATWA non-U.S. taxpayers. The number will be required to verify the individual's non-U.S. status in the income tax system by participating U.S. government agencies.

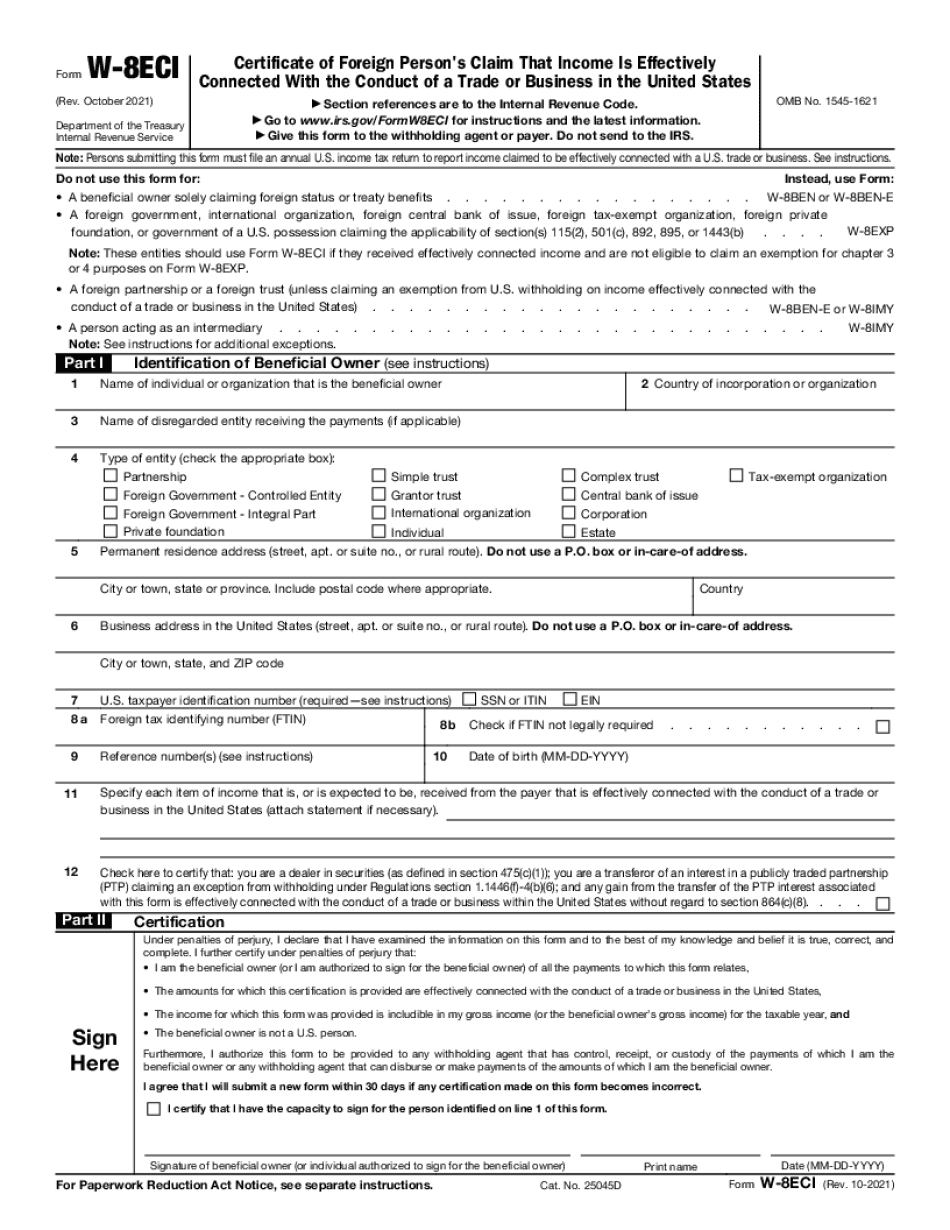

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-8eci, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-8eci online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-8eci by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-8eci from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fatca form w 8