Award-winning PDF software

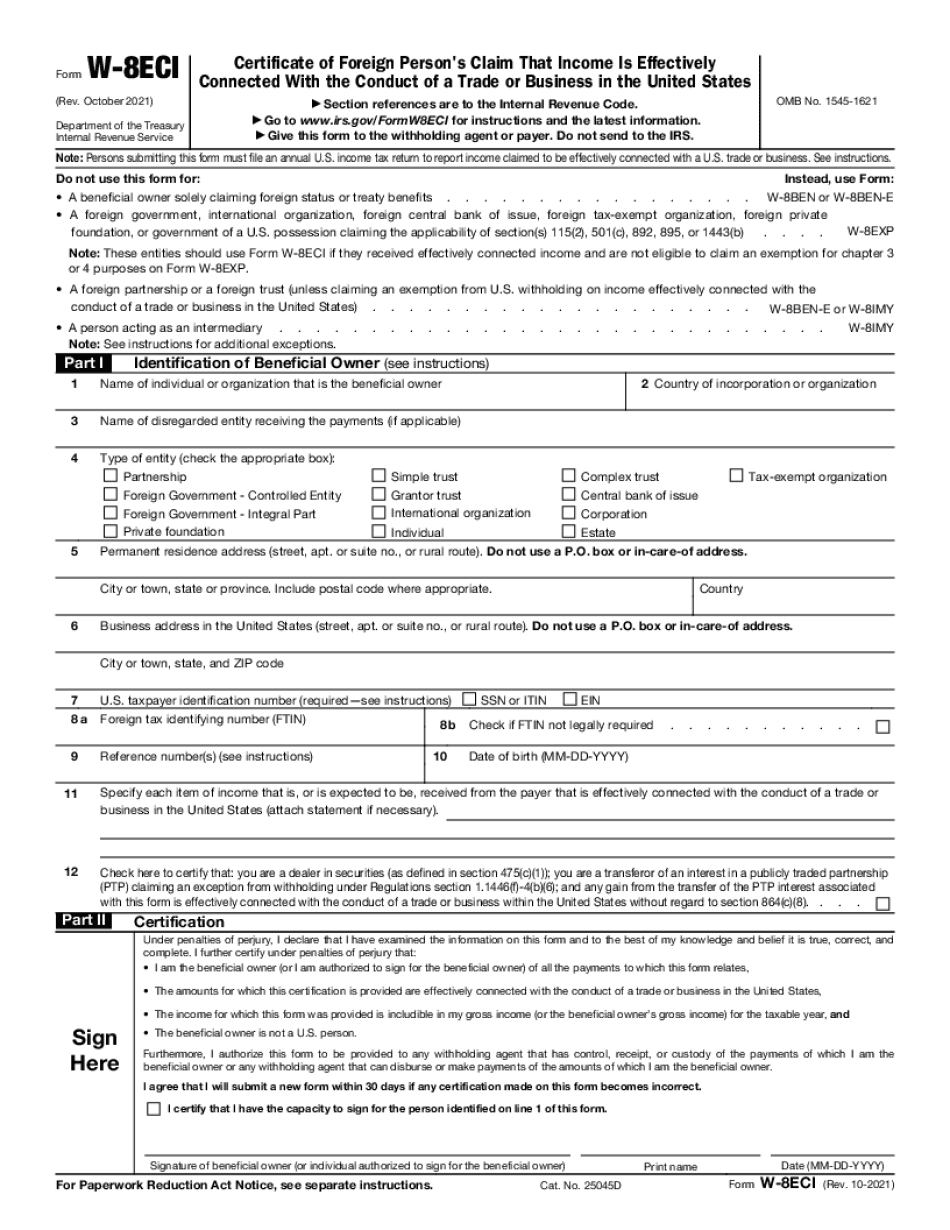

Form W-8eci Carmel Indiana: What You Should Know

See instructions. U.S.-source income = property: cash. Form W-8ECI — FBI Information Needed to File and Get Taxpayer ID Numbers and W-8 Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of A Trade or Business in the U.S. 06-Jun-2017 — Please see instructions for Form W-8ECI. Instructions for the Requestor of Forms W-8BEN, W-8EBI. 06-Jun-2017 — Form W-8HISP and W-8BEN. W-8BEN — IRS W-8 Business Expenses Certificate of Foreign Owner. W-8EBI — IRS W-8 Election Certificate of Foreign Person. W-8HISP — Form W-8 Homeland Security Information Statement. How to File With the IRS If You Live in a Foreign Country When you live in a foreign country, you generally need to file US income tax returns. You also need to file a tax return if you meet the tax filing guidelines. The IRS does not provide a foreign filing certificate for you. If you have an address other than the U.S. and can give your mailing address, you need to file a U.S. income tax return and attach Form W-8 EB (which shows your foreign taxpayer identification number). If you live in a foreign country but can give the tax return address or zip code, send Form 1040NR-EZ to the address shown on Form 1040NR. If you live outside the United States and you cannot get a copy of a foreign return, you must file your foreign income tax return with a U.S. address. You can get a copy of all your income tax returns filed in the United States by filing Schedule D (Form 1040) and attaching it to Form 1040NR. The IRS will issue a U.S. tax return for you and will send the IRS Form 1040NR for each form. If you live outside the United States and cannot get a copy of a foreign return, you must file an American income tax return and attach Schedule C or Schedule C-EZ (Form 1040), Form 1040NR and Form 3800P (Form 3949) to Form 1040NR. In most cases, there is no fee for filing a tax return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-8eci Carmel Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-8eci Carmel Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-8eci Carmel Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-8eci Carmel Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.