Award-winning PDF software

Form W-8eci for Palmdale California: What You Should Know

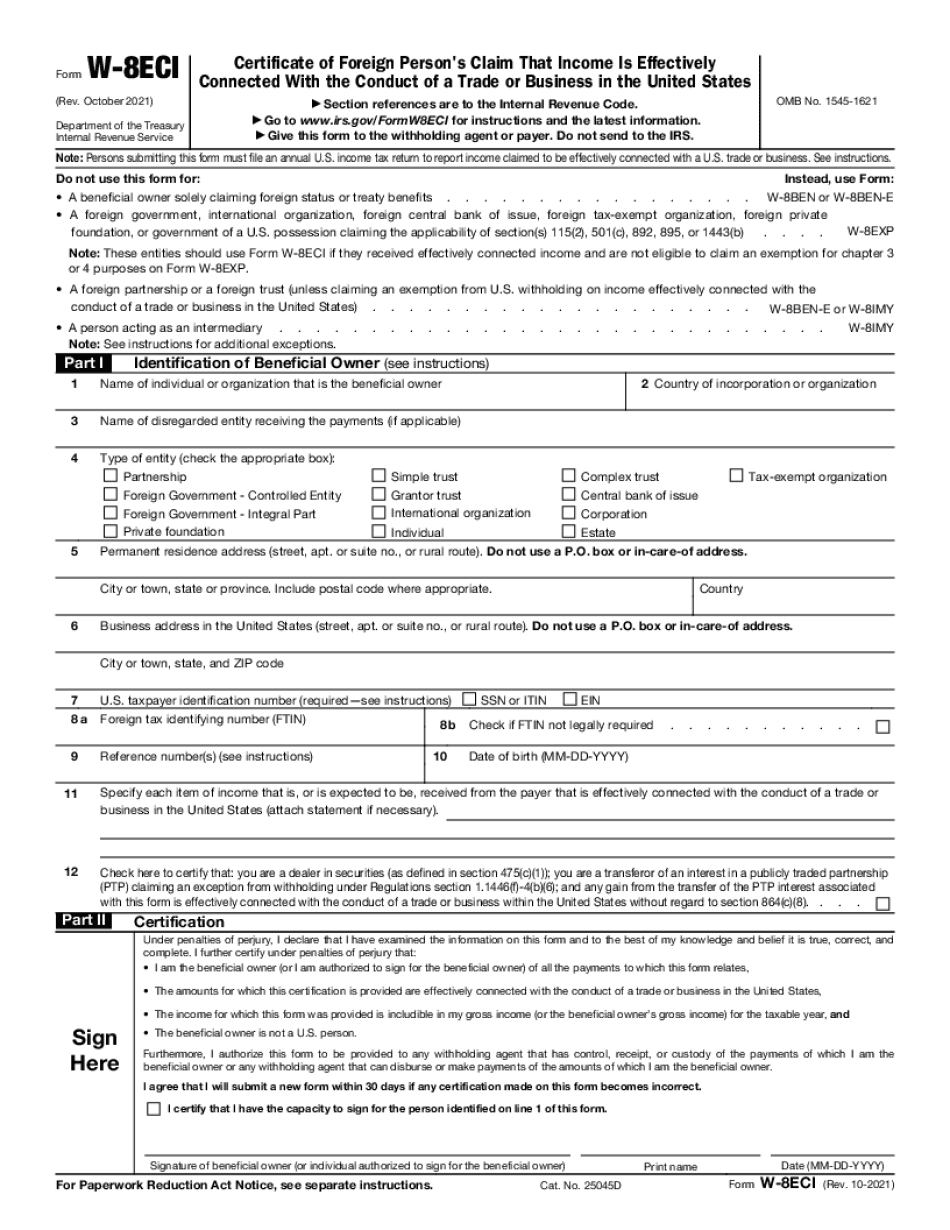

Certificate of Foreign Person's Claim That Income Is Effectively Connected to the Conduct of a Trade or Business in the United States Notice of IRS Notice 90-57, Notice of Federal Tax Lien for Failure to File a U.S. Income Tax Return. Form 8332 Certificate of Foreign Person's Claim That Income Is Effectively Connected with the Conduct of a Trade or Business in the United States. Notice of the Federal Tax Lien of a Tax Avoidance Scheme — Form 8332. Tax Planning Tips for High Income Foreign-Based Taxpayers The tax rules for foreign persons living in the United States vary greatly. The most common rule is the “de minimis exception”. Except certain capital gain or loss. That is, any capital gain or loss on the sale or exchange of property, which is not over 10 million, as long as the gain or loss is not “de minimis” or that could have been avoided with the assistance of the IRS. If, in connection with carrying on a business or being engaged in an activity that is to be carried on primarily within the United States, you own, operate or control property, then you will likely be subject to U.S. taxes. A key factor in the assessment or administration of any income tax is whether it was earned outside the United States. If you are a foreign person, then tax planning is key. Below we offer numerous tax planning tips, which can serve you in the tax process and in your personal life. The IRS may not be able to prevent the use of offshore tax havens, if you are one of the many investors, traders, bankers, and other money managers, who have found that the best way to protect their money, is to invest it in the U.S. financial markets. In fact, there are many U.S. securities exchanges that offer you a convenient way to invest your money, without needing to deal with U.S. securities brokerages or dealing with the heavy legal and administrative burdens involved in the registration and reporting of income and deductions. While many people are interested in investing profits from the sales of their companies, farms or factories through these U.S. Securities Marketplaces. There are tax reasons to avoid doing this. If you do choose to use a U.S. Securities Market, then you must also decide what method of taxation to use on the returns earned.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-8eci for Palmdale California, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-8eci for Palmdale California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-8eci for Palmdale California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-8eci for Palmdale California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.