Award-winning PDF software

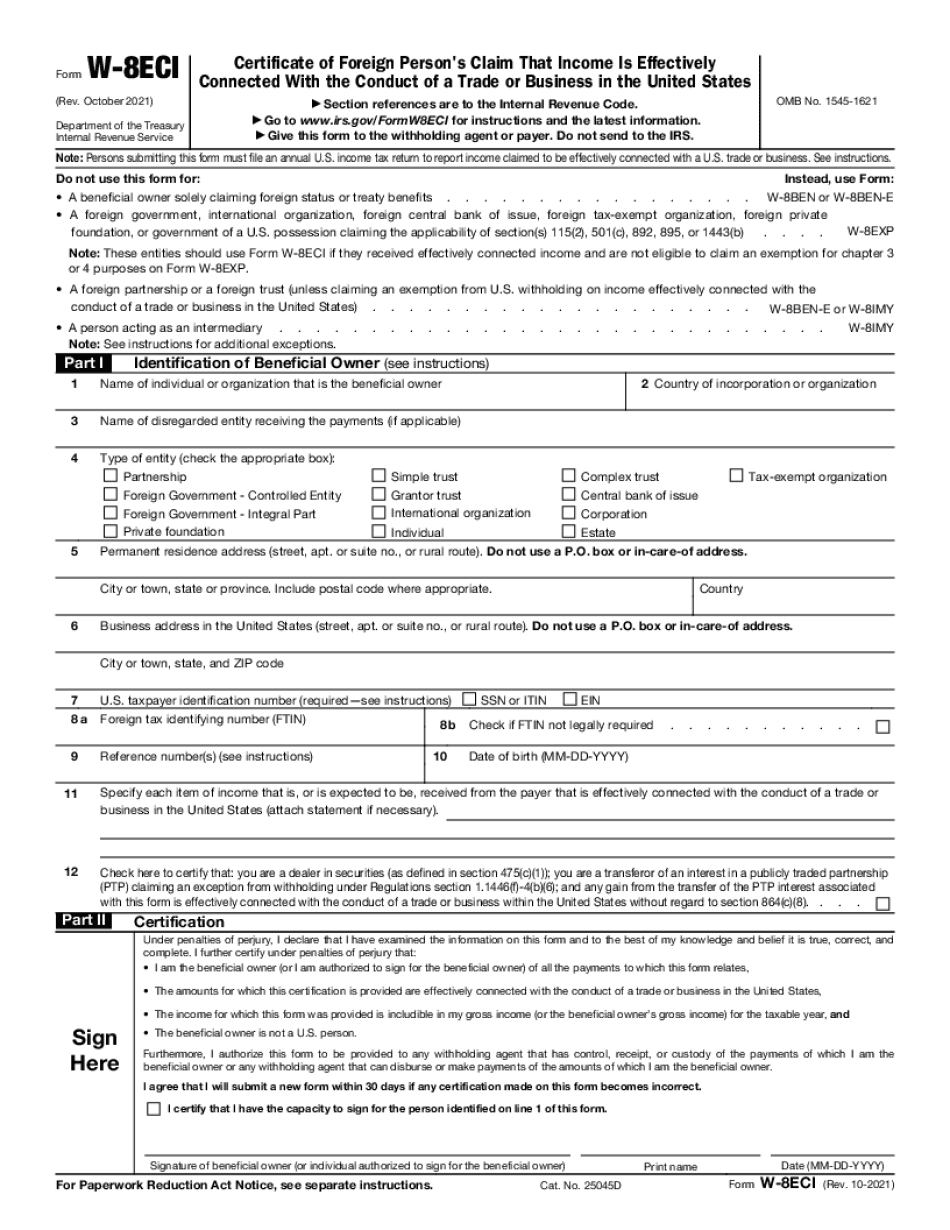

Form W-8eci for Round Rock Texas: What You Should Know

Withholding, 21. IRS Form W-8BEN for Allianz credit union 21, R.S.C. section 6034(a) 21. (a) Form W-8BEN for Allianz credit union may be used for the taxpayer to satisfy the foreign person's claim of exemption from withholding. The taxpayer must provide a Certificate of Exemption from Withholding issued to the taxpayer by the Secretary of the Treasury of the United States or a State tax administrative agency or a local political subdivision thereof. Substitute W-8BEN for w-8, 21. REQUEST TO BE REPORTED. 2, REQUESTED FOR TRANSFER OF TAXPAYER IDENTIFICATION NUMBER (Substitute W-9) 21, c. 2, (a) For the purpose of this section, a taxpayer of any description is a taxpayer of any description by virtue of his or her being of a general nature or by virtue of his or her having been classified by the taxpayer as any other tax type. If a taxpayer is classified by the taxpayer as any other tax type because of any taxpayer identification number furnished to that taxpayer, the taxpayer is considered to be a taxpayer of any description by virtue of that identification number. F, F, F (Rev. April 30, 2017) If you are a resident of a foreign country, you must file your tax returns on a specific format for every tax year to keep them timely. The latest filing method should be available on your foreign taxpayer ID number. The latest tax forms. Form W-9 or W-8. If you are a foreign tax resident, report the Form W9 on a post office box number for the U.S. as the address of the foreign bank. Keep your forms and receipts in a safe place. The date and time of filing your W-8 if timely (at least 10 days, depending on when your filing for the following year's tax year begins) the return. You can fill out this form using Form W-8BEN, Notice of Assessment of Tax in Due Process, to satisfy your tax filing requirement. Or fill out the form as part of Form W-8BEN with all related tax forms. For a copy of Form W-8BEN, see the instructions for Form W-9.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-8eci for Round Rock Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-8eci for Round Rock Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-8eci for Round Rock Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-8eci for Round Rock Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.