Award-winning PDF software

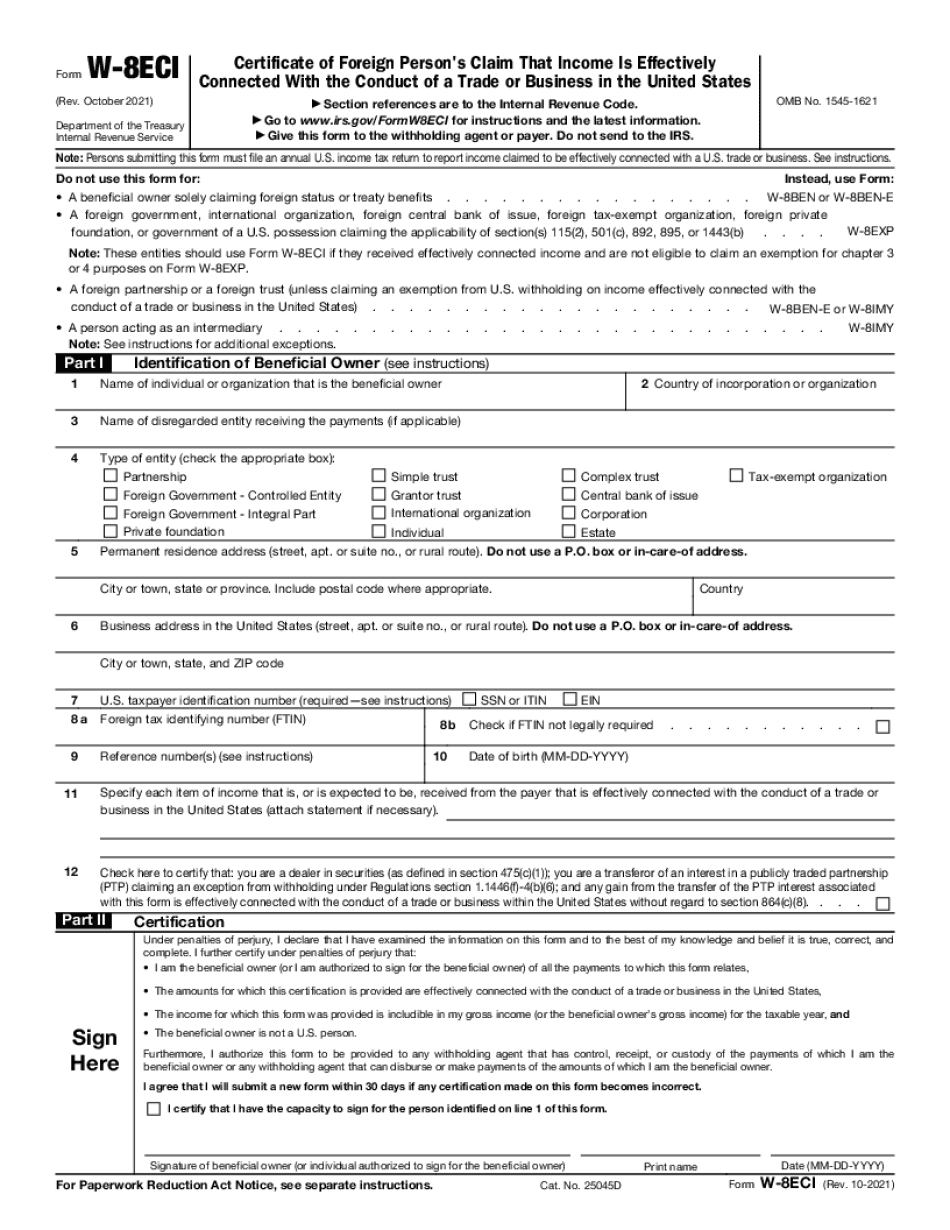

Form W-8eci for Stamford Connecticut: What You Should Know

Filing. • Certification of Foreign Person's Claim to be Exempt. What To Do When Your Landlord Fails To Pay The Taxes Required by the Landlord-Tenant Law The New York Times : Landlords are often at the forefront of efforts to combat the rental housing crisis in New York City. They often set up rental properties to cater to a community, and then try to recoup as much money as they can from renters. By Amy Grumman, A.A., L.C. • April 14, 2025 • A landlord's complaint has put tenants and lawmakers on alert about a threat they did not see coming: an IRS form they will not soon forget. Tax lawyers and tenants in New York City may soon see these “exemption certificates,” known as W-8ECIs, in the hands of landlords with increasing frequency. Tax protesters have long contended that landlords who fail to pay rent on time, or to maintain rental properties, are breaking a law they call the Fair Housing Act. The law requires landlords in New York City to make sure that no more than a certain percentage of residents pay their share. The certificates were devised as a tool for landlords that they say can collect unpaid taxes. But now tenants and lawmakers say that landlords are abusing them and threatening to use the certificates to avoid paying their taxes — and even to evict tenants. Last Tuesday, two tenants were evicted from a Bronx building they were renting together, after losing an IRS-issued exemption certificate that the court held was valid. A third tenant who has been evicted four times is in danger of losing an exemption certificate she received after she pleaded guilty to a felony charge and completed a five-to-six-month prison sentence. “These certificates are supposed to protect tenants from harassment and extortion,” said Barbara L. Khan, a lawyer advising tenants in the case of the three tenants, all of whom are black or Latina. “Now they are used as a shield for extortion.” She said that on the eve of the court case, a tenant was evicted from a New York City building in 2010. The landlord claimed the tenant failed to pay rent on time, even though he had the rent payment record in his possession and provided the tenant with several receipts of past payments. “The government should not be using these certificates for any purpose,” Ms. Khan said.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-8eci for Stamford Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-8eci for Stamford Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-8eci for Stamford Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-8eci for Stamford Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.