Award-winning PDF software

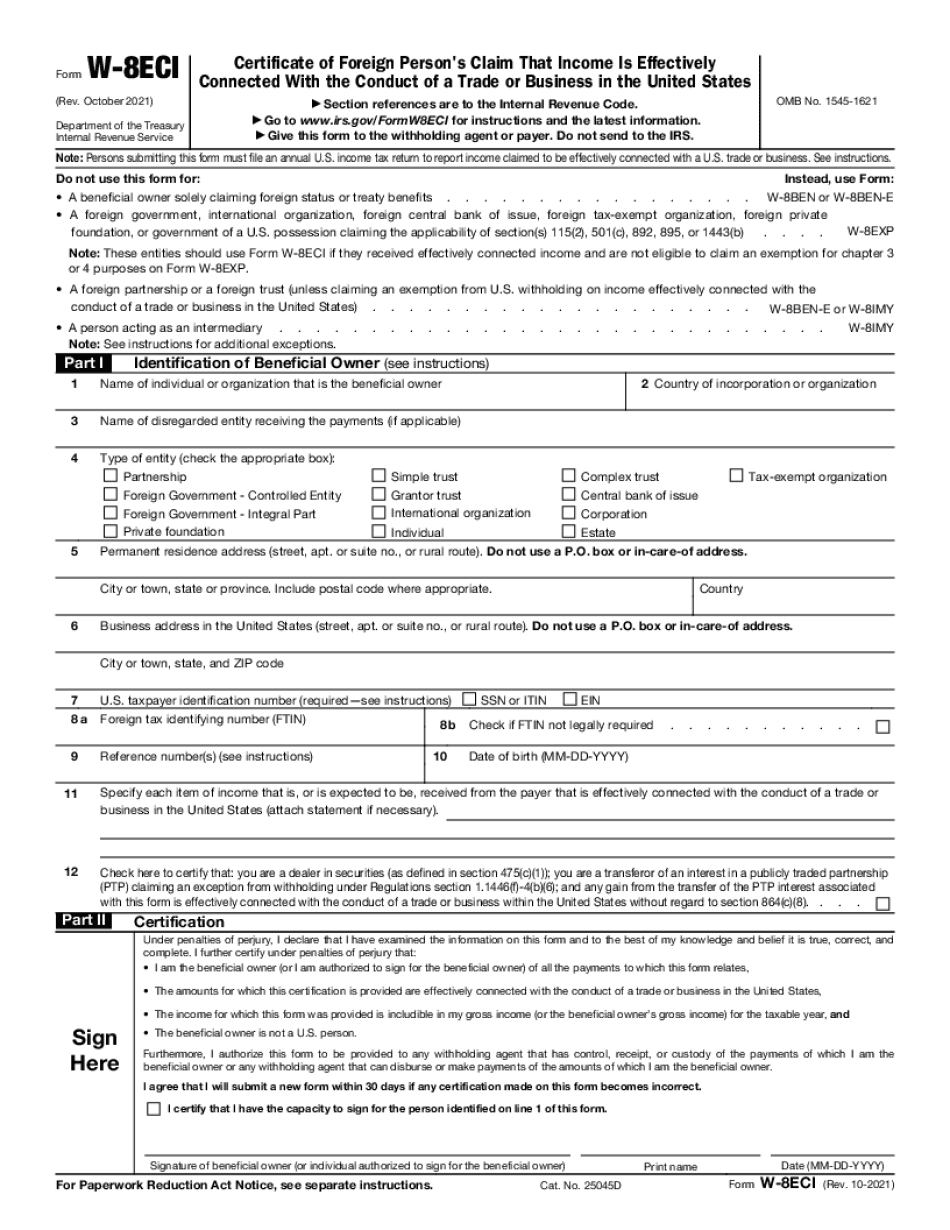

Form W-8eci online Bellevue Washington: What You Should Know

See also, Rev. Run. 77-19. Apr 30, 2025 — For purposes of this Ruling, a person who is an individual, whether a U.S. citizen or national, a resident thereof, or an alien is considered to be residing in a foreign jurisdiction when, notwithstanding the individual's permanent residence in or status in such foreign jurisdiction, he has either (1) entered into a legal or physical relationship with a foreign person that arises out of or involves a business or other activity in such jurisdiction, or (2) established himself as the legal owner, custodian, or manager of real or personal property owned in a foreign jurisdiction, in a jurisdiction that: (i) is party to an international agreement regulating or relating to property rights between the United States and such foreign person or on foreign soil and (ii) is party to an agreement of international tax or customs conduct signed by the President of the United States or an international organization or agency of which the United States is a party that regulates or relates to property rights between the United States and such foreign person or on foreign soil. Rev. Run. 77-19 In my hometown, there is this “beware” person who works for the IRS. It is always difficult to keep track of who his clients are. Most of them are in the insurance industry. I know there are some in the financial sector but no one really bothers to name the people he deals with. I don't know many in his field, but he always seems to be involved in something that has to do with “money.” When I first saw it he was doing the following… “You don't have enough money to declare all of your income. But you should declare your assets to the IRS, so your tax savings are higher. “ —From an “applicant” on his Facebook page, May 6, 2016, When I first saw this he was doing the following… “You want to be sure that you need to take a deduction or not because if you do it now, you will be facing consequences later. Therefore, by waiting until you are faced with a tax liability, you will be able to save tax on any tax you currently owe, and also get help with planning for any future tax situation.” —From another “client” on his Facebook page, Mar. 3, 2017 Well said to be honest…it is just a matter of which is your personal opinion.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-8eci online Bellevue Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-8eci online Bellevue Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-8eci online Bellevue Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-8eci online Bellevue Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.