Award-winning PDF software

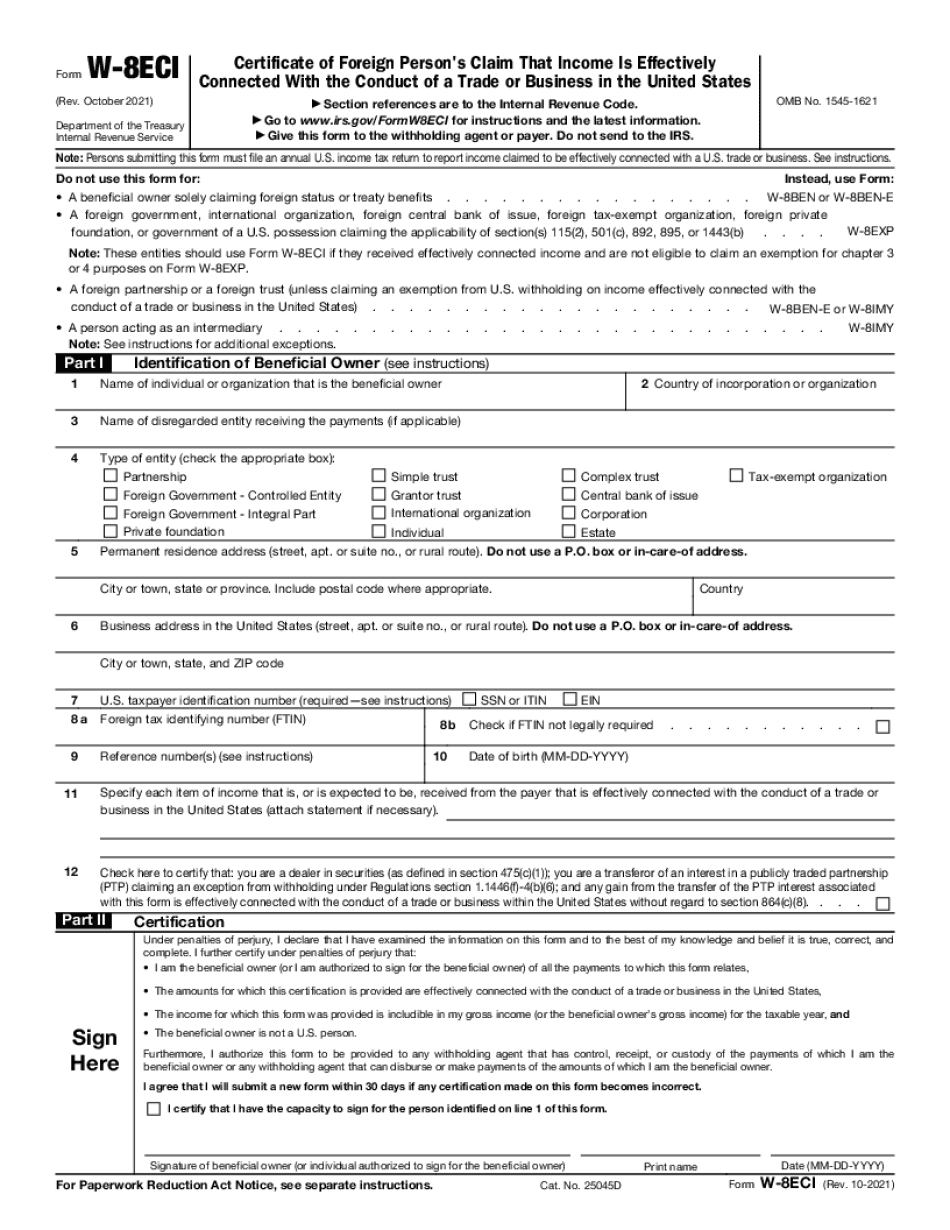

Manchester New Hampshire online Form W-8eci: What You Should Know

If a filer has previously been approved access, a form must be requested for each additional case. Only cases that are still pending will be available for viewing. This form can only be requested by an individual who is requesting a case. You may not have access to the family business account, and all accesses will be logged in to your NH Business Account. If you receive this form by email that has not been signed by you, then it may be in error, and you cannot proceed. If you are an authorized user, then please print and complete this form, sign it and deliver it to the case agent or payer. Please do not mail it to the case agent or payer as that will not receive a response. Only authorized users have access to the family business account. If you become authorized to access more cases through the NH case access portal when this form is not signed for, you will automatically receive this form when you next use your account. The user will then need to print and complete this form before accessing more case files. NHL New Hampshire Department of Revenue Forms 2018 Filing Deadline — October 28, 2018, Important — You may not know if you need to start your own business, start a company or other type of business in New Hampshire because most people just don't know the right steps to take. This is the time to determine that to yourself. This form is used to provide information to the New Hampshire Division of Business and Economic Development as required by the Business Tax Act. All filers must complete this form in order to obtain a receipt or statement on which to calculate the percentage of an additional deduction which may be taken using an information reporting system. Form G-1 — New Hampshire Income and Business Tax Return Required to file in accordance with chapter 7, article 10 of title 31 (§ 31-7-15). New Hampshire Division of Revenue, Division of Business and Economic Development Division of Financial Affairs Division of Financial Institutions Division of Insurance Division of Taxation 2018 Filing Deadline — October 29, 2018, Form G — 1 New Hampshire Tax Return: Filing Requirements and Penalty Required to file in accordance with chapter 7, article 10 of title 31 (§ 31-7-15).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Manchester New Hampshire online Form W-8eci, keep away from glitches and furnish it inside a timely method:

How to complete a Manchester New Hampshire online Form W-8eci?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Manchester New Hampshire online Form W-8eci aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Manchester New Hampshire online Form W-8eci from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.