Award-winning PDF software

Norwalk California online Form W-8eci: What You Should Know

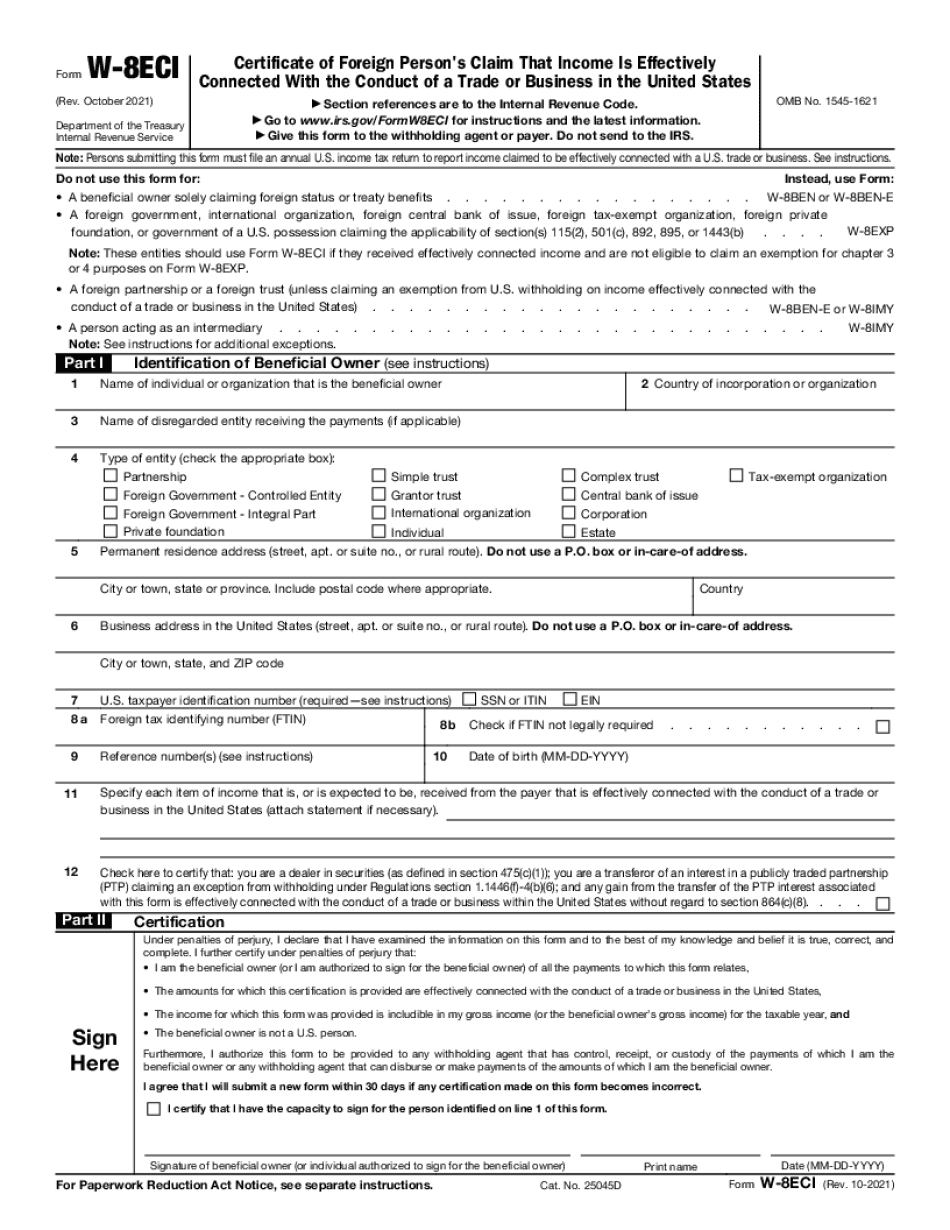

This form is intended for use by individuals who are not US persons, and who are renting property to non-US persons under a lease or other rental arrangement, whether they are US persons, foreign persons or otherwise. For individuals not renting from a US Airbnb host, do not attach this form. The form is one-page long and does not have to have all the forms attached. If you have multiple Airbnb accounts in multiple countries with different ownership, or your Airbnb account is held jointly by two or more US persons, then attach all forms you need to. If none of your Airbnb accounts have a shared account holding a joint account, then have each of your individual Airbnb accounts have a copy. Form W-8ECI: Certificate of Foreign Person's Claim for Exemption From Withholding on Income Effectively Connected with Conduct of a Trade or Business in the US. This form is used to verify if the person who rented to you (the non-US person) is a “foreign person” for purposes of the US federal withholding tax. The form must be attached as Item 1 in the IRS Form 1040 (or Form 1040NR), along with the person's other tax return and all the other required information as described above. You may attach this form for tax purposes if the person who rented you are a foreigner, even if (a) the Airbnb user (you) did not actually receive money, securities, or other property (see example 2 below) from the Airbnb user, or (b) the non-US persons with whom you do business are American and the transaction is for purposes other than to facilitate the Airbnb user's rental of property; or (c) the person whose conduct is subject to the US federal income-tax (for example, a host or hostels) did not actually receive money, securities, or other property (see example 2 below) from the person whose conduct was subject to the US income-tax (for example, the Airbnb user who rented to you). Example 2: a US person owns an account with six Airbnb hosts in their home country in order to rent out a property to US guests. One such host, a US citizen who lives in Russia, pays each of their hosts US30/night in exchange for their hosting service: each host receives US3,000/ night.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Norwalk California online Form W-8eci, keep away from glitches and furnish it inside a timely method:

How to complete a Norwalk California online Form W-8eci?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Norwalk California online Form W-8eci aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Norwalk California online Form W-8eci from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.