Award-winning PDF software

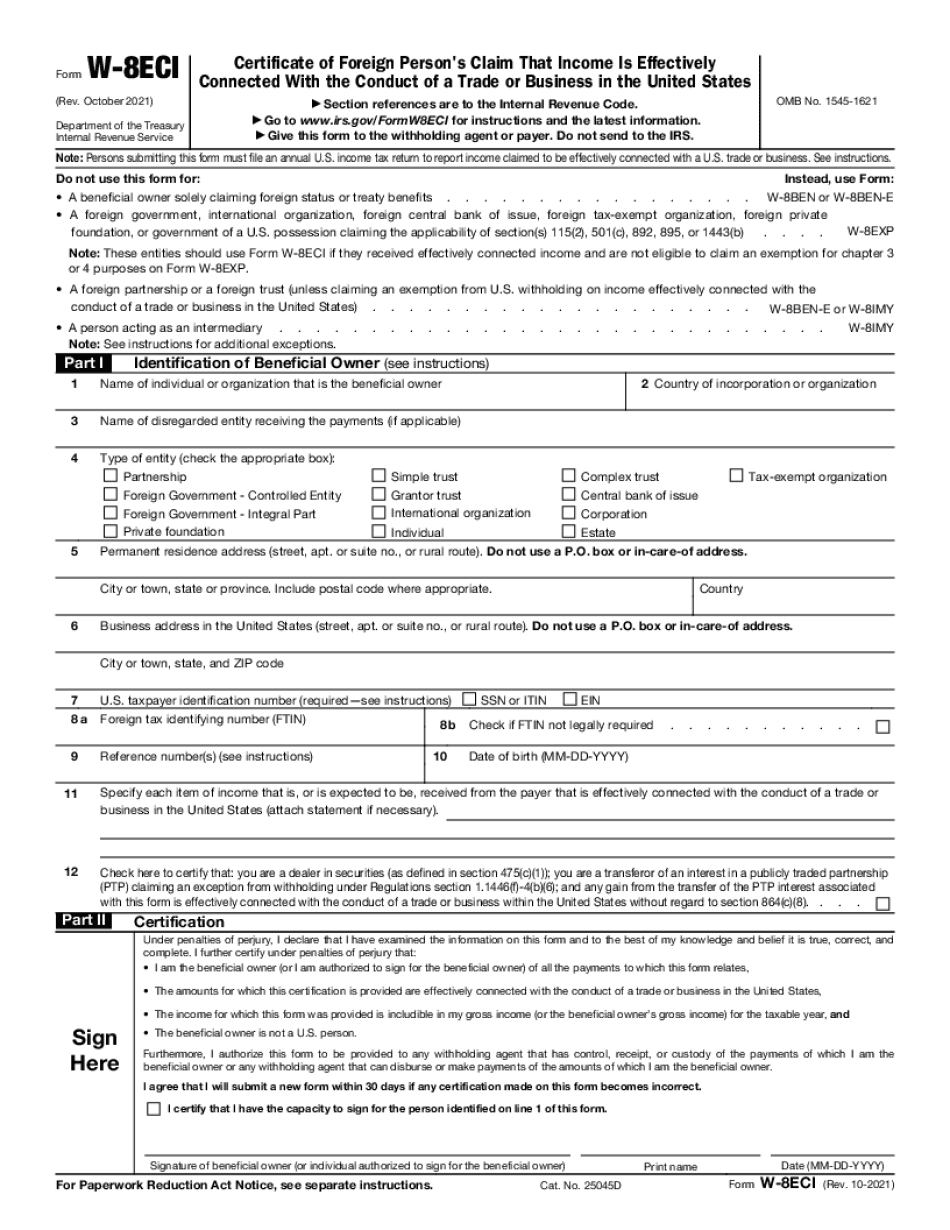

TN Form W-8eci: What You Should Know

Income Tax Provisions For Aliens and Foreign Entities The IRS has published a number of regulations regarding filing of Form 1040X with foreign income tax withholding and reporting-entities (Wins). IRS Publication 552 — Foreign Business and Certain Foreign Entities; Foreign Corporations; Foreign Real Estate Investors; and Foreign Trusts is all that is needed to determine income taxes for certain aliens, corporate members, and foreign entities if you are from an IRA country. If your taxable income includes foreign source income, see IRS Publication 543. Foreign Corporations — 1040X Withholding and Foreign Business Entity Exemption IRS Publication 542A — Foreign Corporations and Foreign Real Estate Investors — Foreign corporations have been granted a foreign business income tax exemption for the tax period for which they are required to file their U.S. income tax return. In addition, the IRS will allow taxpayers from low income foreign countries to maintain deductions for foreign income taxes paid to other countries, if they have no U.S. source income and file either Form 2555 or Form 2559 annually. See IRS Publication 544A for more information. IRS Publication 746 — Foreign Earned Income. This is an extension of the general withholding requirements of IRC Section 6213. Exemption for Foreign Business (B) Tax in 2025 to 2015 IRS Publication 742 — Foreign Corporations. In 2012, corporations created under the foreign tax credit provisions of IRC Sec. 3101(a) (which may have a foreign bank account and be taxed as U.S. corporations with respect to dividends, interest or income) are no longer tax-exempt as they had been in prior years. IRC Section 61 is also extended so that foreign tax credits may now be claimed against any foreign source income. The tax on income taxes under Section 71 will remain the same as it is today. IRS Publication 746 — Foreign Corporations. Tax credits may be claimed for foreign income taxes paid to the United States or to certain countries for which a credit has been claimed before. The credits can be claimed in each tax year in which they are earned or held. In addition, the credit is allowed for the entire tax year for which an income tax return was filed which is on file for all foreign corporations. The credit allowed for a tax year will depend on the calendar year in which the return is filed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete TN Form W-8eci, keep away from glitches and furnish it inside a timely method:

How to complete a TN Form W-8eci?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your TN Form W-8eci aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your TN Form W-8eci from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.