Award-winning PDF software

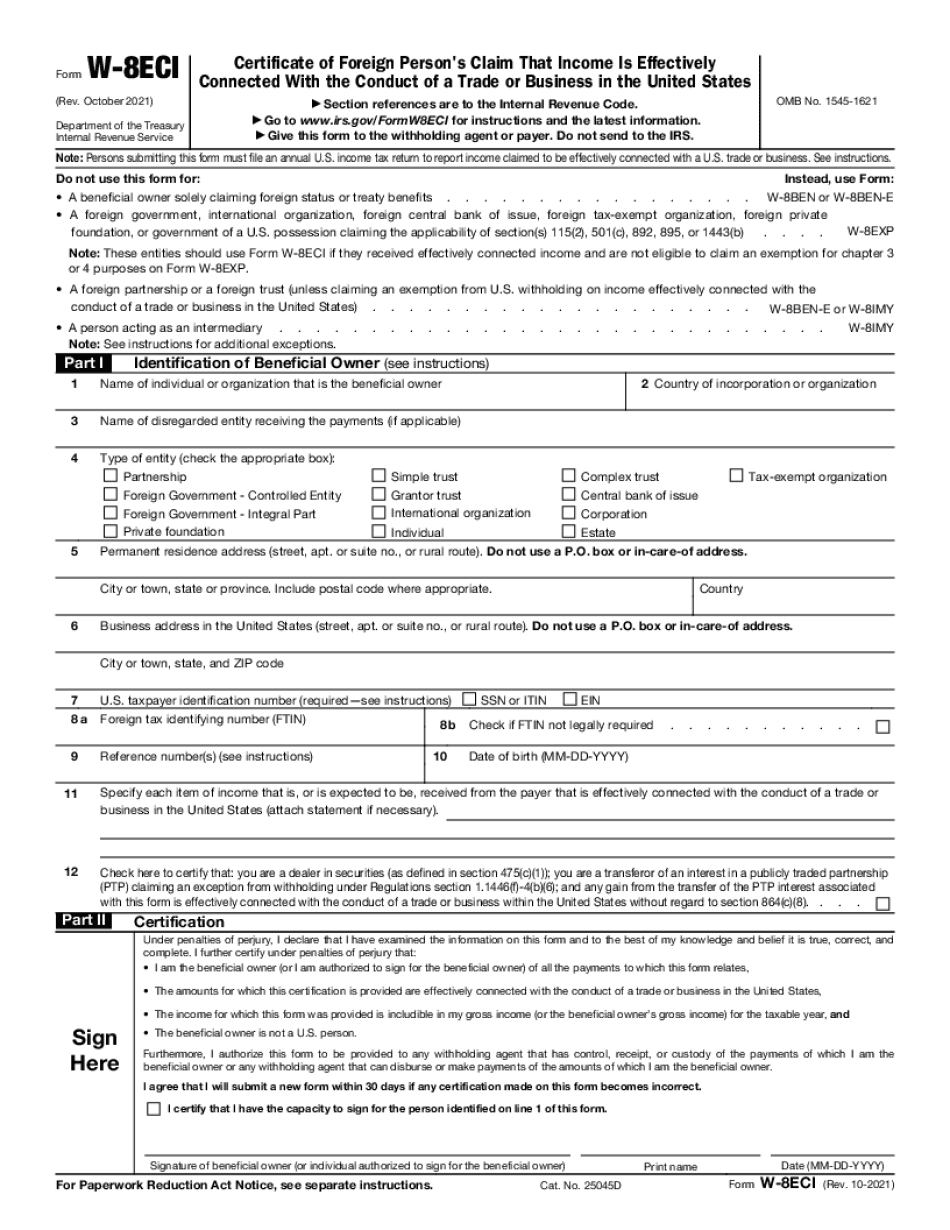

VA online Form W-8eci: What You Should Know

On Form 828, a corporation, partnership or limited liability company (LLC), or individual whose shareholdings exceed 30,000 (including amounts representing deferred rental income), must file a U.S. form; see Section 5.7 for more information on the withholding for certain taxpayers. On your last day of taxation, you will need to file Form 8285 or Form 8288. See section 828(a) or 8285(a) for information on how to apply and claim the foreign tax credit. Instructions on how to file Form 8285 — (fatwa) | USE Financial Corporation U.S. taxpayers may receive a refund or credit of any overpayment (determined as of the due date for the return) for a return filing requirement. You received funds from a tax-exempt organization, and you use them to purchase U.S. property or services that are taxable under Section 875. Do not include that property or services on your tax return, and use Form 8758 instead. You cannot claim an itemized deduction for the capital cost of property held by non-resident aliens or aliens who are subjects of the income tax treaty between the United States and their non-resident alien affiliates. Foreign Persons Receiving Funds from a Tax-Exempt Organization You must report an overpayment in box 2b of the form 1040 (or an overpayment of foreign tax credit in line 38) if you are a foreign person receiving funds from a tax-exempt organization. The overpayment is subject to the same rules and reporting requirements for reporting and recovering foreign tax credits as would apply if the money were paid to you directly. If you are a non-resident alien, you are generally considered a United States resident because you are physically present in the United States, but you are not considered to have earned U.S. income except to the extent you earned it. However, if any section 974 payment is made to you on an installment basis, you will be considered to have earned U.S. income in the year for purposes of figuring the foreign tax credit. This form is the successor to Form 8288-B. Instructions on how to file Form 8288-B — (fatwa) | The Islamic Foundation for Aid to the Needy and a number of other websites The following information is derived from: Foreign person receiving funds from a tax-exempt organization; or, “U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete VA online Form W-8eci, keep away from glitches and furnish it inside a timely method:

How to complete a VA online Form W-8eci?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your VA online Form W-8eci aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your VA online Form W-8eci from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.